At the last count, there were 110,337 active cases of coronavirus around the world, with the condition already responsible for 3,831 deaths. As well as the human tragedy that’s unfolding, the economic impact of the outbreak continues to deepen. Data released late last month revealed a steep fall in Chinese factory output, while the surge of cases and the subsequent lockdown in the north of Italy has ramped up eurozone fears.

The coronavirus outbreak has already a significant impact on the global supply chain and the fortunes of businesses in diverse industries around the world. However, with no sign of any respite in its relentless march, what could the potential impact be?

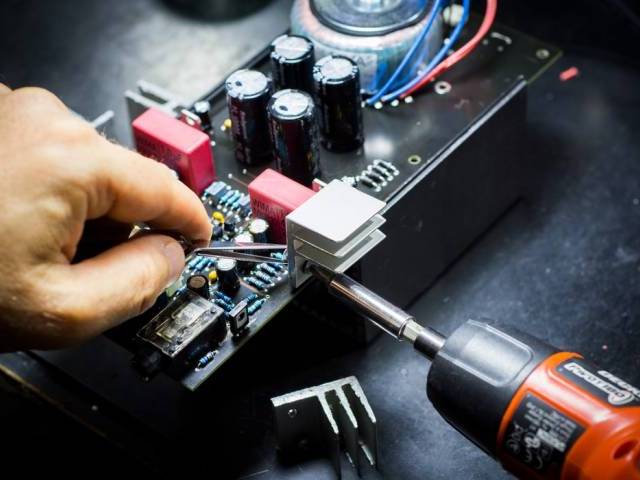

The toll on the Chinese manufacturing sector

The Chinese manufacturing sector, which millions of businesses around the world are reliant upon, has been hit hard by the relentless spread of Covid-19. A report released in February showed a plunge in Chinese factory output as quarantine efforts to contain the disease were put in place. That lead to the closure or understaffing of thousands of factories across China.

Britain’s largest carmaker Jaguar Land Rover has added its voice to a chorus of companies that are already counting the cost of the outbreak. It has warned it will soon run out of car parts at its British factories as the coronavirus halts supplies from China. That comes after the car manufacturer admitted it had been bringing in parts into the UK from China in suitcases.

Even the most powerful companies are not safe. The tech giant Apple has sounded the alarm, warning of potential iPhone supply shortages resulting from the closure of its Chinese factories, while Tesla has had to put its business in China on hold. Transport groups, hospitality chains, luxury goods makers, retailers and airlines have also been among the hardest hit, with consumers staying away from the shops and travellers putting off travel plans.

The worst is yet to come

The impact of Covid-19 on global supply chains has already been hugely damaging, but the predictions are that the worst is yet to come. The peak of the impact is expected to occur in mid- to late-March, forcing thousands of companies in Europe and the US to temporarily shut assembly lines or even close manufacturing plants permanently.

The most vulnerable companies will be those that rely heavily or solely on factories in China for parts and materials. Although the number of coronavirus cases in China is now falling, the activity of Chinese manufacturing plants is expected to remain depressed for months. That’s the inevitable impact of current efforts by the Chinese government to quarantine almost half of its population and the knock-on effect that has had on transportation.

Supply lead times are also expected to delay the peak of the impact. Shipping to Europe or the US from China takes an average of 30 days. With many Chinese plants ceasing manufacturing before the beginning of the Chinese holiday on 25 January, the last of their shipments will have arrived in the final week of February. By mid-March, with no new supplies on the horizon, production in UK companies will inevitably grind to a halt. And, once the slowdown does hit with full force, it could last for months.

It’s business as usual at PER-International

Whether you want a job or need to recruit in the global electronics industry, we are the specialist recruiters to turn to. We place and find talented candidates in the UK, the USA, Ireland, across Europe, in India, South America and Singapore. Just get in touch to discuss your requirements with our team.